Part 2

In Part 1, we explored the escalating threat of severe convective storms (SCS) and their financial implications on the insurance market. This section references The New York Times for insights from industry experts (As Insurers Around the U.S. Bleed Cash From Climate Shocks, Homeowners Lose; Christopher Flavelle reported from Iowa and spoke with more than 40 insurance experts, officials, and homeowners in a dozen states. Mira Rojanasakul analyzed insurance market data for carriers across the country. By, The New York Times) and then examines the critical role of reinsurance in addressing these challenges.

Case studies from Iowa:

- Dave Langston lives in Cedar Rapids and Langston struggled for months to find new insurance after his provider left Iowa. He worries that without coverage, a single severe storm could bankrupt all 17 homeowners in his association. “If we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said. Langston’s ordeal is a stark example of the challenges faced by many.

- Near Des Moines, Dr. Brandi Mace Storm’s home was damaged by hail. Despite receiving a check for repairs, her insurer, Pekin, dropped her and all its other homeowners in Iowa. She found it nearly impossible to secure new coverage for her damaged roof. Pekin’s spokeswoman, Susan Crisler, explained that rising repair costs and severe weather made it unprofitable to operate in the state.

- A general contractor near Marshalltown, Kuehner saw his annual premium jump by 42% following damage from the 2020 derecho. Despite the sharp increase, he managed to find new coverage, but the rising costs are straining many homeowners in similar situations.

Expert Insights:

- Bill Montgomery is CEO of Celina Insurance Group, Montgomery acknowledges the harsh reality insurers face. “Climate change is real,” he said. “We can’t raise rates fast enough or high enough.”

- Carolyn Kousky is Associate vice president for economics and policy at the Environmental Defense Fund, Kousky warns that the impacts of climate change on insurance are just the beginning, with broader repercussions for housing and local economies.

Industry Perspective:

- Sridhar Manyem is Senior director of industry research at AM Best, Manyem explains the unsustainable nature of current insurance models. “It’s becoming an untenable situation,” he said, pointing to the increasing frequency and severity of bad years.

The Role of Reinsurers:

Reinsurers are the backbone of the insurance industry, providing coverage to insurance companies for catastrophic losses. However, as climate change drives more frequent and severe weather events, reinsurers are becoming more reluctant to underwrite policies in high-risk areas.

This reluctance from reinsurers has made primary insurers more conservative. Unable to secure affordable reinsurance, many insurers are either raising premiums, cutting back on coverage, or exiting markets entirely.

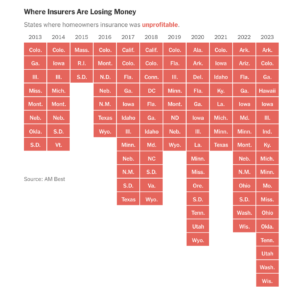

National Trends:

The problem extends beyond Iowa. States across the Midwest, Southeast, and West are seeing insurers pull back as reinsurers hike rates or refuse coverage. In Arkansas, for instance, insurers spent $1.66 for every dollar earned in premiums last year. Similar pressures are felt in Kentucky, Tennessee, and Utah, where insurers are grappling with increased wildfire risks. (The Home Insurance Crunch: See What’s Happening in Your State; written by Christopher Flavelle and Mira Rojanaskakul at The New York Times)

Ian Smith reports for the Financial Times about the evolving landscape of the reinsurance industry, which is becoming increasingly visible and scrutinized. Reinsurers, who insure primary insurers, play a crucial role in spreading risks, particularly for natural catastrophes. Recently, property and casualty (P&C) reinsurers have raised their prices and toughened terms due to climate change and inflation. This has led to a steep rise in home insurance costs as reinsurers charge more to cover the growing risks associated with climate change and inflation. As a result, primary insurers are left with a larger share of the risk, particularly for events like thunderstorms and hail.

Smith highlights the need for the reinsurance industry to protect consumers and ensure that reinsurers can fulfill their commitments. (It is right that reinsurers are finding it harder to fly under the radar? Industry plays vital role in spreading risk but the business model is changing; written by Ian Smith at Financial Times)

Innovative solutions, like those offered by our team here at Demex, are crucial in addressing these gaps and ensuring the resilience of the insurance market. In Section 3, we talk more about these solutions.

Read Part 3: Innovative Solutions for the Future of Insurance