Matt Coleman, and I recently had the opportunity to speak with Matthew Grant and Henry Gale at InsTech about new reinsurance coverage that our team here at Demex launched late last year.Check out the podcast!

Demex Retained Climate Risk (RCR) Reinsurance is a first-of-its-kind layer of protection for insurers. Policies cover the risks of non-catastrophic, higher-frequency weather events that typically occur within the retention layer. These events now are occurring five times more frequently than they were in the 1980s. Demex RCR supplements traditional reinsurance programs to minimize underwriting losses for insurers.

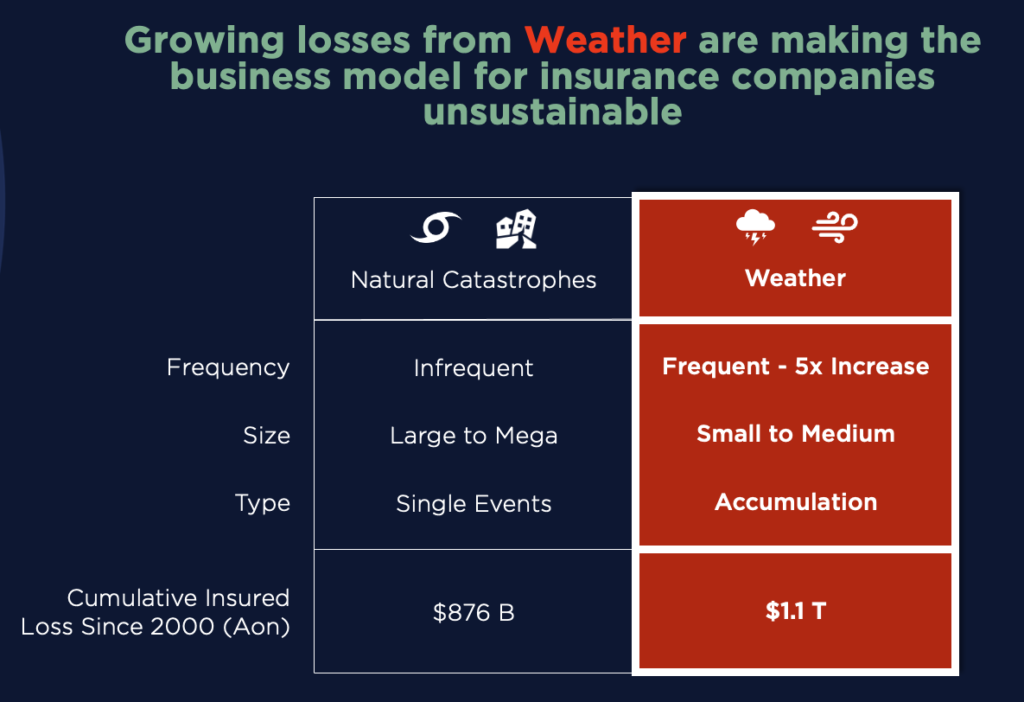

Natural catastrophes like hurricanes and earthquakes are quite rare (1-in-100, 1-in-250, or 1-in-500) but, when they occur, they cause widespread destruction and total loss for large portfolios of insured properties. Accumulated loss from natural catastrophes exceeds $850 Billion since 2000. Non-catastrophic weather like heat-waves, severe convective storms, blizzards, flooding rain, etc, are more frequent (1-in-5, 1-in-10, 1-in-20) and, when they occur, they don’t usually cause widespread destruction or total portfolio loss. Accumulated loss from non-catastrophic weather exceeds $1.1 Trillion over the same two decades.

Reinsurance typically covers catastrophes on a “per event” basis while weather coverage functions to cover the accumulation of events over a period of time (such as a calendar year).

Many of the risk models used in the insurance market are built to understand natural catastrophes. Modeling weather events (which occur far frequently and cause smaller losses) requires fundamentally different data sets and methodologies.

We are a technology-enabled MGA, spun out from Munich Re in 2020. We structure (re)insurance products covering non-catastrophic weather risks for SMEs, corporates and insurers. Our differentiator centers on first-party data from a business or insurer’s historical losses as linked to weather events from historical weather and climate data.

Once we have verified Demex model stability, we partner with the reinsurer to develop forward-looking probability distributions that form the basis of the ultimate underwriting decisions. This step is critical because we must factor in the changing nature of risk over time, as linked to climate change. Historical simulation of loss events is completely meaningless if such events would have a different distribution in the current climate.

We develop customized indexes of weather variables as a proxy to measure what the organization would expect to lose from a weather event. These indexes are used to deliver a parametric insurance product. We monitor the parametric and, if it exceeds the predefined threshold, the policyholder receives a claim payment.

Midwest U.S. insurer works with us for reinsurance to cover growing weather losses

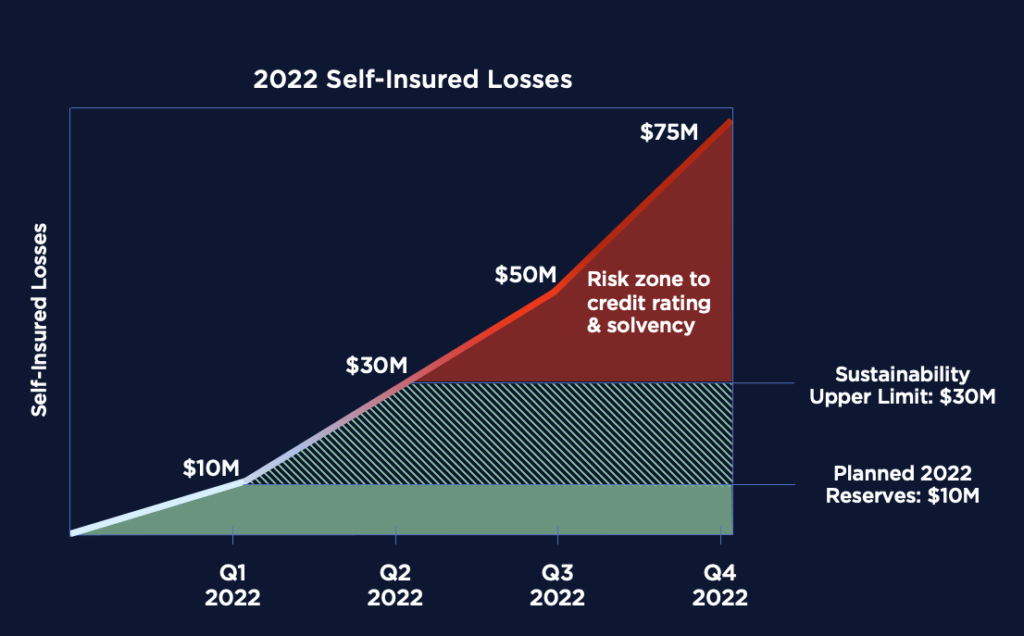

An insurance company in the Midwest US experienced escalating weather-related losses over recent years, which put its surplus at risk. A surplus is a form of retained earnings an insurer holds to provide a cash buffer against unforeseen circumstances. If a series of weather events occur in a year, causing more loss than expected, the surplus is the capital set aside to pay those claims. Historically this insurer’s weather risk was around $10 million USD per year. But midway through 2022 it found that its weather-related losses were exceeding $30 million USD and eventually rose to more than $50 million USD. Once losses reach a certain threshold, it becomes financially undesirable to hold that much risk on the balance sheet. Many insurance companies in the US are faced with this exact problem.

We worked with the insurer, its reinsurance broker, and reinsurers to structure a parametric reinsurance product with a customized index that models the expected losses the insurer would face from weather events.