There are three pillars of sustainability – environment, society, and economy – and each is crucial to human and ecological health. Sustainability must be approached from a systems perspective and investors are forming investment approaches that promote multidimensional results. At the nexus of insurance and climate, Demex is focused on climate change adaptation and resilience by improving economic sustainability.

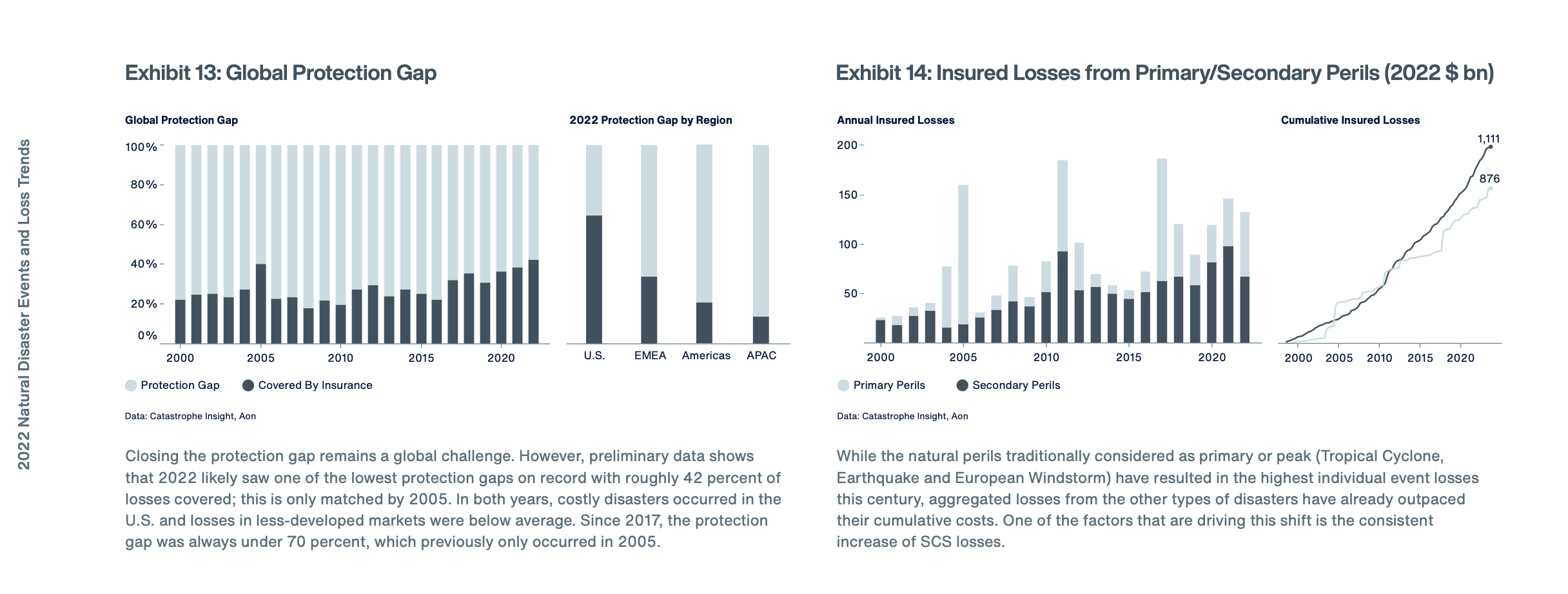

Climate change is increasing the frequency and volatility of non-catastrophic weather. Today, in fact, annual economic losses from these events (e.g. thunderstorms, snowstorms, heat waves, floods, drought) often surpass annual losses caused by natural catastrophes (e.g. hurricanes and earthquakes).

Against this backdrop, insurance serves as a necessary adaptation measure: physical climate risks are growing and economic backstops are essential for capital planning and fostering the longevity of sustainability efforts. In this vein, adaptation through protection against climate risks occurring today complements mitigation investment efforts whose positive effects might not be achieved until years or decades into the future.

With respect to physical climate risks, Demex:

- closes economic protection gaps in developed and transitioning economies

- reduces the likelihood of revenue shortfalls, increased capital costs, and increased insurance premiums resulting from unpredictable weather events

- transfers risk from individuals and institutions to the insurance sector to stabilize balance sheets and allow capital to flow more efficiently towards investments in innovative resilience solutions

Insurance companies remain vulnerable to frequent weather events, which have grown rapidly owing to climate change. The resulting inundation of claims has become unsustainable, which increases earnings volatility and can lead to credit rating downgrades or even insolvency. In addition, the amount of capital reserves needed to self-insure climate risks has tremendous opportunity cost like inhibiting future growth and innovation.

Demex created Retained Climate Risk Reinsurance (RCR Re), which is an adaptive measure that transfers an insurer’s physical climate risk to reinsurers to bolster economic sustainability. Demex’s expertise in economic climate risk modeling and insurance products enable insurance companies to continue offering affordable coverage by stabilizing their earnings and credit standing.

Initial demand has been strong amongst regional and national insurance companies with exposure in the central United States who insure individuals, farmers, agribusinesses, and SMEs. As we expand this product offering, we expect our impact to be largest in cities and concentrated urban locations where the density of property is highest.

Demex product offerings include not only climate risk insurance but also insights into how economic risks associated with weather are trending due to climate change. As part of our core technology, Demex’s analytics enable an insurer to identify which properties in their portfolio are most exposed. This is also valuable to reinsurers (who ultimately sell the protection to insurers), because they can price climate risk with higher confidence that is not possible via existing natural catastrophe models that are not built for the purpose of evaluating the risk of frequent weather events.

Importantly, the impact of Demex’s climate insurance products can be measured. Metrics such as number / type / location of policyholders and assets covered; dollars of protection offered; and timing of insurance payments following weather events allow impact investors to quantify:

- the degree and speed with which climate-economic protection gaps are closing

- the geographic locations of assets exposed to climate risk and how they overlap with locations of climate risk trends

In addition, classification frameworks can be designed to measure the sustainable impact of climate insurance underwriting opportunities relative to one another by rating dimensions such as:

- who is insured (e.g., emissions creator vs. ESG champion)

- what is insured (e.g., low impact sector vs. high impact sector)

- where is the insured (e.g., low need vs. high need economy, rural vs. urban)

Demex solutions address a critical market gap and provide valuable insights into economic climate risk to promote adaptation, resilience, and ultimately sustainability.