Our team was recently featured as one of 25 emerging technology-led businesses well-placed to help insurers succeed. Over 150 companies were reviewed for this distinction and I’m excited that our team’s achievements placed us into focus this year!

What is the Insurtech-25?

Oxbow Partners highlights 25 innovative companies each year and I’m particularly proud to join a cohort of companies that I respect as true innovators in this arena.

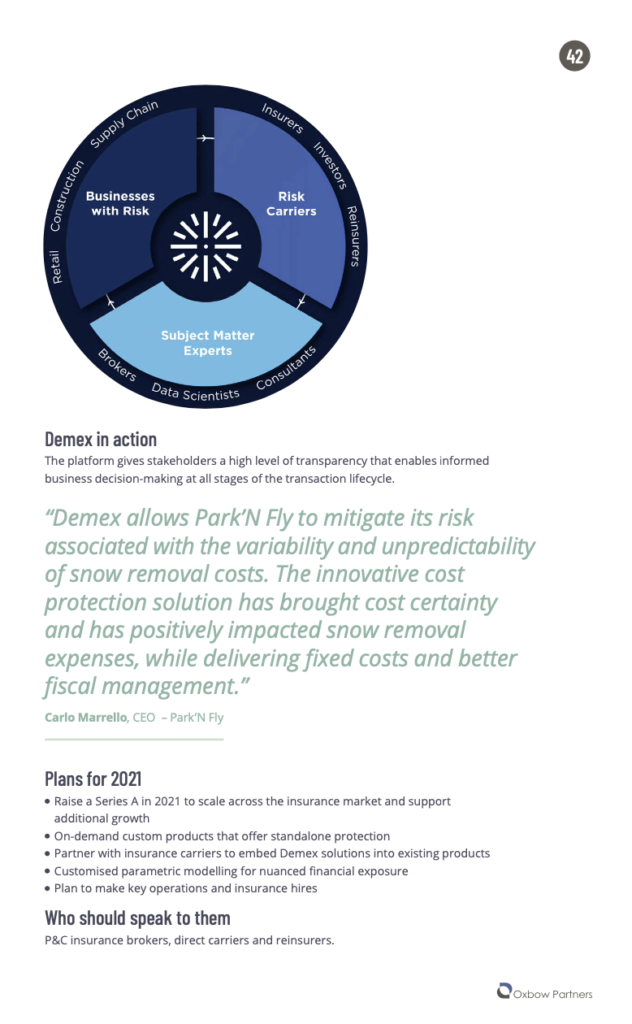

The Oxbow Partners view: Demex is riding two key trends in insurance – solutions to the effects of climate change and parametric solutions. This is an active space which really started to gain momentum in the last 24 months. Last year we included Descartes Underwriting in our Impact 25, a company with a similar proposition and in 2019 we considered FloodFlash and discussed how parametric solutions broaden the span of insurable risks by requiring an understanding only of frequency and not severity. Demex is also an example of the confluence of insurance and other financial services. We discuss this in this year’s report with regard to credit risk and commodity price risk, where solutions could be both insurance products and other financial products. Insurers thinking narrowly about the existing product definitions and structures could get left behind in a market where leaders are thinking about customers’ risk management requirements and exploiting a range of structures to solve them. Oxbow Partners, Navigating the Digital Decade: 25 emerging technology-led businesses well placed to help insurers succeed.

Why does Insurtech include Climate Resilience?

Climate resilience requires planning for, operating within, and recovering from weather extremes (Building Climate Resilience into Business Operations). Insurtech creates avenues for financial recovery following extreme weather. Demex technology empowers insurers and financiers to cover these climate-linked financial losses. Customized Parametric Insurance, Property and Casualty Insurance, Business Lines Insurance and/or Financial Derivatives are all commonly used methods for protecting against extreme weather related losses due to unexpected increase in costs or lost revenue. Relatively small preemptive premiums can provide significant financial recovery following bad weather.

Why did they select us?

We were selected into the Insurtech-25 because we bring together risk management and climate science to analyze, price and transfer non-catastrophe climate-linked risks at scale. Our parametric solution operates at the intersection of insurance and capital markets. We estimate that US businesses currently hold c.$70bn in unprotected climate-linked risks on their own balance sheets. These risks include loss in revenue and spikes in costs due to weather fluctuations. Public and private sector enterprises currently do not have established solutions to measure, manage and transfer these risks. Demex helps these enterprises to understand and transfer these risks to pre-certified carriers.

Clients see Demex as a ‘shock absorber’ for non-catastrophe weather risks emerging from climate change.

Spun out of Munich Re, Demex launched in late 2019 with a team of seasoned risk advisors, data analysts, climate specialists and technology experts. Munich Re remains a partner and risk carrier, along with Nephila Capital. Since raising their $4.2m seed round in 2020, Demex has built out their core technology platform and facilitated risk transfer in commodities, snow removal and weather derivative markets.

President Eisenhower noted that “urgent [issues] are not important, and important [ones] are never urgent.” As the Covid crisis passes into history, the imperative for change might become weaker, but preparing for the future of insurance has never been more important. Oxbow Partners, Navigating the Digital Decade: 25 emerging technology-led businesses well placed to help insurers succeed.

What’s the road ahead?

I’m excited about 2021 because, according to Oxbow, “embedded insurance is no longer an innovation experiment but, in our opinion, a necessary investment to stay relevant for a large part of the future insurance premium pool.” Demex is launching a set of micro products for insurers to embed climate resiliency solutions into their existing products, such as homeowners or business insurance policies.

For example, we’ve built supplemental protection for homeowners who are exposed to excessively high utility bills during a heat wave or cold spell. Coverage is priced and calibrated to average daily temperatures and priced in units of $100 total coverage. Coverage can be scaled up to any value to align with typical utility bills in any zip code.

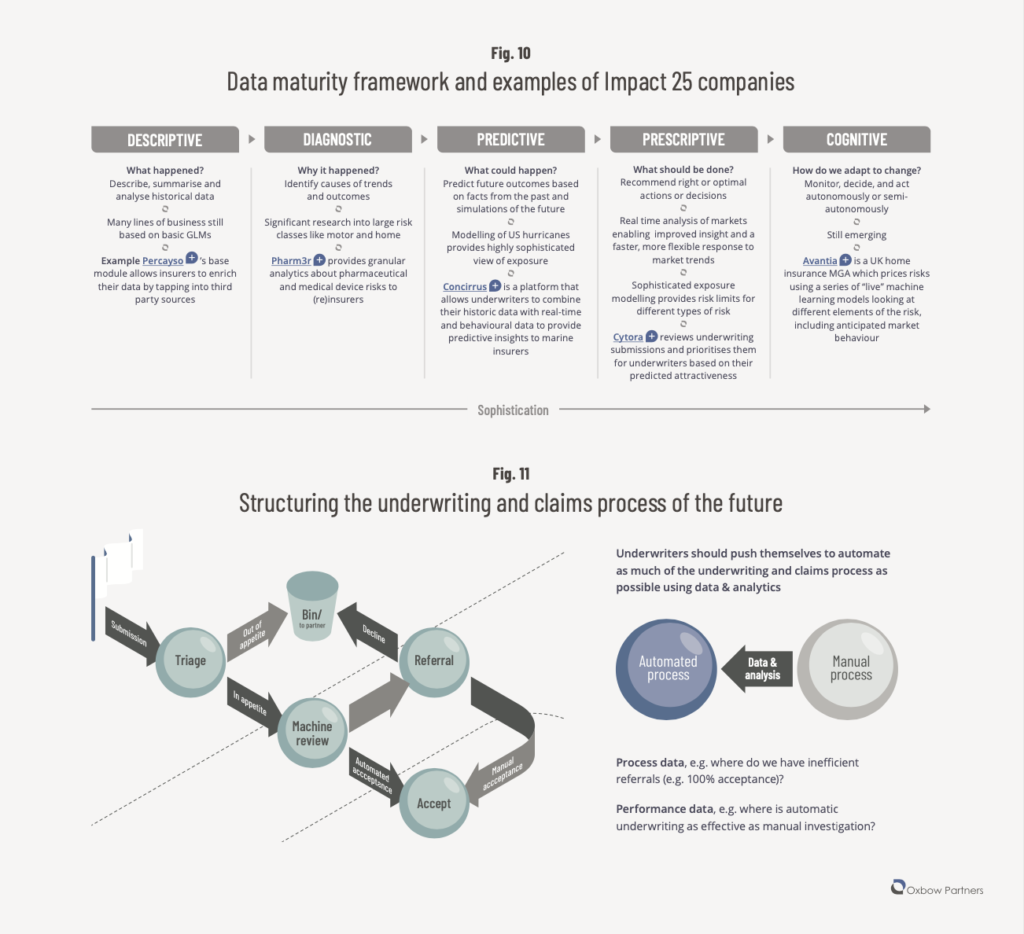

This will also be a year for automation. Insurers will be developing their capabilities and maturity within a framework of data that describes particular risk (“what happened”?) through to better predictive insight (“what could happen”?) and ultimately to cognitive insight (“work it out for me”). The Demex architecture allows for all levels of data maturity. We leverage traditional weather data and also work directly with data innovators and partners with proprietary indices of their own. Our network of partners is growing quickly and I’m excited that I will be announcing new relationships in the year ahead.

I’m focused on three main priorities for our team this year: (1) on-demand custom products that offer standalone protection; (2) systematic yet customized parametric modeling for nuanced financial exposure; (3) partnerships for embedding Demex climate resilience into existing insurance products.

Hi, we’re The Demex Group.

We know that climate change is one of the greatest financial risks facing our economy. The world is changing: weather patterns are increasingly unstable and present unique risks for businesses. Public and private sector enterprises currently lack the expertise to precisely assess and offset their operational risks linked to increasingly volatile weather. Thanks to increasingly precise scientific datasets, a larger volume of historical data, and new technology allowing us to quickly analyze vast amounts of data, we can now pinpoint how climate change will affect individual businesses and what they can do about it.

I began this post by highlighting the team whose work was selected for Impact-25. Now let me conclude my thoughts by again highlighting this extraordinary group of people. I’m grateful to work alongside such a diverse set of talent, experience, and personal backgrounds. I’m honored to have assembled this group virtually during a global pandemic and creating a corporate culture where flora and fauna stand alongside each Demexer as part of the family reinventing risk transfer for Climate Resilience. Meet the team.